Welcome Dosto, Aaj Ham Bahut hi asaan bhasha me baat karengey 5 Unique Money Management tips ke bare me jiski madad se ham apne paiso ko kaha kese kab aur kis tarha kharcha karna hai ya kese paiso ko bachana hai save karna. ummeed karte hain ke ye 5 tareeke apki life me apko paiso ko save karne me apki madad karengey. Paisa hamari life me sab se zyada zaroori cheez hai jo ki bahut mehnat se kamaya jata hai aur jesa ki ham sab jante hain aaj ki date me agar apke paas paisa hai to sab apke hain to kyu na apne paiso ko sahi jagha kharcha kiya jaye aur in 5 Unique Money Management Tips ki madad se bachaya jaye.

1. 50/30/20 Rule Ko Apnayein

50/30/20 niyam ek simplified budgeting tareeka hai jo financial planning ko simple banata hai. Ismein yeh hota hai:

- 50% Needs Ke Liye: Aapki income ka 50% hissa essential needs jaise ki housing, utilities, groceries, aur transportation ke liye use karein.

- 30% Icchaiyon Ke Liye: 30% hissa aap un cheezon par kharch karein jo aapko khushi deti hain, jaise dining out, entertainment, aur hobbies.

- 20% Savings Aur Debt Repayment Ke Liye: Bacha hua 20% hissa savings, investments, aur debt repayment ke liye istemal karein.

Is balanced approach se aap apne zaroori kharchon ko cover kar sakte hain, zindagi ke anand ka luft utha sakte hain, aur ek strong financial foundation bana sakte hain.

2. No-Spend Month Challenge Ko Apnayein

No-spend month ek aisa tareeka hai jisse aap apne spending habits ko reset kar sakte hain. Aap ek month chun sakte hain aur sirf necessities par hi kharch karne ka commitment karein. Isse aap samajh sakte hain ki wants aur needs mein kya antar hai. No-spend month mein bachaye gaye paise ko aap apni savings, debt repayment, ya future goals ke liye use kar sakte hain.

3. Apni Savings Ko Automate Karein

Apne checking account se automated transfers set kar dena ek simple aur powerful technique hai. Isse yeh ensure hota hai ki aap regular basis par ek hissa apni income ka savings ke liye rakhenge bina usko kharch karne ka mauka mile. Samay ke saath, yeh habit aapke liye substantial savings accumulate karne mein madadgar ho sakti hai.

4. Sirf Cash Ka Istemal Karein

Specific weeks ko “cash-only” weeks designate karein, jismein aap apni purchases ke liye physical cash ka istemal karenge. Is tactic se mindful spending promote hota hai kyun ki aap physically dekhte hain ki paise aapke wallet se nikalte hain. Yeh eye-opening ho sakta hai aur aapko unnecessary expenses kam karne mein madad karega.

5. Envelope Budgeting System Ko Try Karein

Envelope budgeting system ek unique aur tactile tareeka hai financial management ka. Alag-alag spending categories jaise ki groceries, entertainment, aur dining out ke liye envelopes create karein. Har month ke shuruaat mein har envelope mein fixed amount cash rakhein. Jab ek envelope khali ho jata hai, tab tak aap us category mein aur paise nahi kharch kar sakte hain, agle month tak. Is method se discipline enforce hoti hai aur overspending roka ja sakta hai.

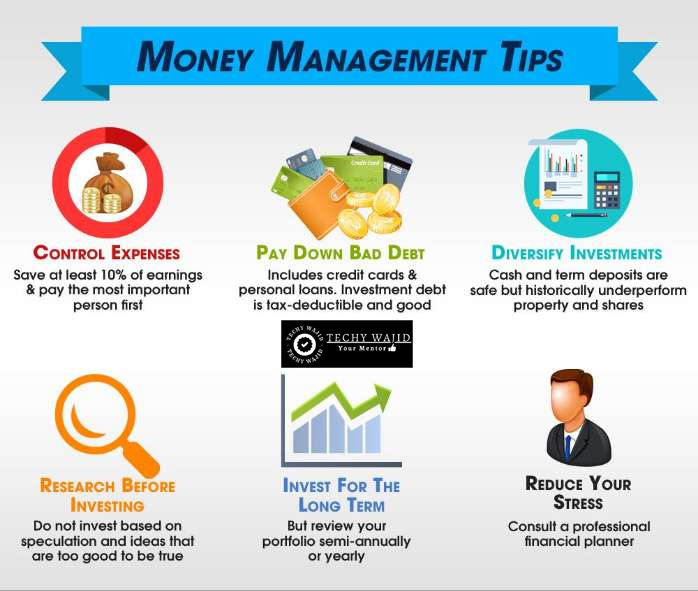

Successful 5 Unique Money Management Tips Paise Management Ke Liye:

- Realistic Budget Banaayein: Apne paise ko samajhne ka pehla kadam hai ek asli budget banana. Budget ek plan hota hai jismein aap note karte hain ki aap kitne paise kaise kharch kar sakte hain. Ismein likhna hota hai ki aapko kitne paise milte hain aur aap unhe kis tarah se vyayit karenge. Isse aap samajh sakte hain ki aap kis cheez par kitna kharch kar sakte hain aur kis cheez par bachat kar sakte hain. Ek asli budget banana, aapke paise ko control mein rakhne aur aapke financial lakshyon tak pahunchne ka ek ahem kadam hai.

- Emergency Fund (आपातकालीन निधि): Emergency fund ek aisa savings account hai jo aapke liye surakshit rakhne ke liye hota hai jab aapko anjaane mein kharchon ka samna karna padta hai, jaise medical emergency, ghar ke marammat, ya job loss. Yeh paisa aapko asaani se access karne ki anumati deta hai jab aapko uski sabse adhik avashyakta hoti hai. Ek aacha emergency fund aapko aise samay mein madad karta hai jab aap jarurat padne par bina vyapar kiye apne paiso ko kharchne ke liye nahi hote hain. Isse aapki financial sthiti ko stable aur surakshit rakhne mein madad milti hai.

- Bhavishya Ke Liye Nivesh Karein: Apne paise ko behtar roop se prabandhit karne ke liye, apni financial knowledge ko badhayein. Books, podcasts, aur online courses ka sahara lekar apni vittik gyaan ko sudhar sakte hain. In resources se aap paise ke prabandhan, bachat, aur nivesh ke bare mein behtar samajh sakte hain. Yah aapko financial success ki disha mein madad karega aur aapki Financial swasthya ko sudharne mein madadgar sabit hoga.

- Seek Professional Advice (Vyavsayik Salah Ki Khoj Karein): Agar aapke pasankh ho rahe vittik paristhitiyan hain ya aapko vittik salah ki avashyakta hai, to ek vittik salahakar se salah lene ka vichar karein. Vittik salahakar aapko aapke vishesh paristhitiyon ke anukool margdarshan dene mein madad kar sakte hain. Unka sujhav aur paramarsh aapko behtar Financial nirnay lene mein madadgar sabit ho sakte hain.

Conclusion : Yeh 5 Unique Money Management Tips aapko apne finances ko control mein rakhne, dhan banaane, aur aapke Financial lakshyon tak pahunchne mein madadgar sabit ho sakti hain. Yaad rahe ki financial success ke liye aksar discipline, dhairya, aur samajhdaari se paise ke chunav lene ki pratigya ki avashyakta hoti hai. In strategies ko lagoo karke aur apne Financial swasthya ke prati samarpan bana kar, aap ek ujwal Financial bhavishya ki ore kadam badha sakte hain.

IMPORTANT LINKS FOR YOU

(Must See)

Personal Finance : Your Comprehensive Guide to Financial Success

DigiLocker Signup & Download – DigiLocker CBSE Results

Insurance Claim Form – All In One Site

Documents Required For Indian Passport & How To Apply Passport Online

PAN CARD | Aadhar Card Pan Card Link | Download | Status | Linking

Aadhaar Card Download | Status | Update | Password | All Details

Apply For Driving License

E Challan UP – E Challan AP

Right Way to Buy Insurance

Types of Motor Insurance | All Complete Details

Online sites for buying Insurance :- CLICK LINKS