Vehicle Insurance Common Add-Ons Coverage Details (Motor Insurance Add-ons Coverage)

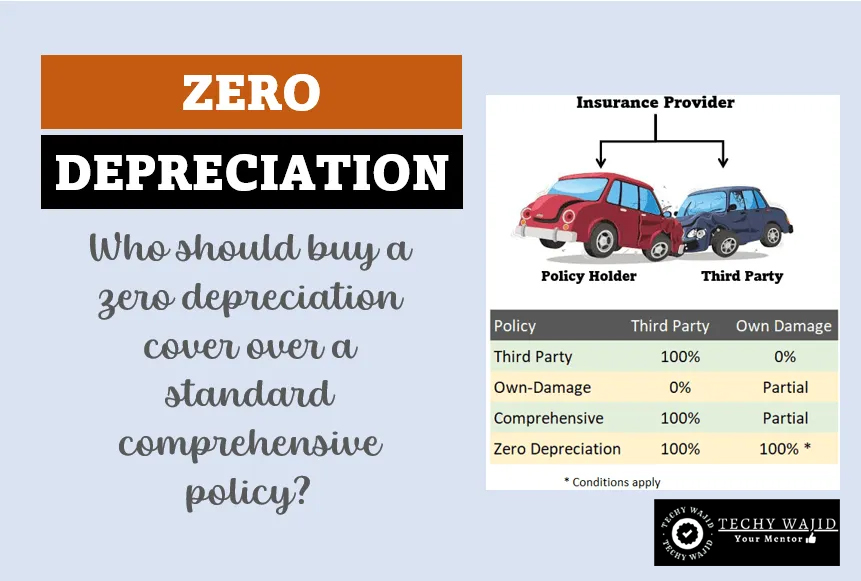

1. Zero Depreciation

Zero Depreciation, Also known as Nil Depreciation or Bumper to bumper insurance is a unique feature offered in motor insurance policies, Unlike standard insurance, which factors in depreciation while settling claims, Zero Depreciation coverage ensures that you receive compensation for the full cost of repairing or replacing damage car parts without accounting for depreciation. This can be especially advantageous for newer vehicle and those equipped with advanced technologies.

Benefits of Zero Depreciation Coverage (Motor Insurance Add-ons Coverage)

- Zero depreciation coverage is highly beneficial for new cars, as their value depreciates significantly in the initial years. This coverage ensures that you do not have to bear the brunt of this depreciation when making a claim.

- High End cars often come with expensive parts and advanced technology. Zero Depreciation coverage ensures that you are adequately compensated for the cost of these parts, which may be subject to higher depreciation.

- New or inexperienced drivers may have a higher likelihood of minor accidents. Zero Depreciation coverage helps alleviate the financial burden of repairing such damages.

- Cost Savings : You save in out of pocket expenses as the insurer covers a larger portion of repair costs.

- Peace of mind : You can drive with confidence knowing that even in case of damage you won’t have to bear the burden of depreciation related deductions.

- Timely Repairs : This coverage encourages Prompts repairs, maintaining your vehicle’s aesthetics and safety features.

Limitation & Considerations

- Age of the Vehicle : Zero Depreciation coverage might have limitation based on the age of the vehicle. Some insurers offer this coverage only for cars up to a certain age, often around 2-3 years.

- Higher Premiums : Opting for Zero Depreciation Coverage typically result in a higher insurance premium compared to standard coverage. However the benefits often outweigh the increased cost, especially for newer or high value vehicles.

2. Consumables Coverage (Motor Insurance Add-ons Coverage)

Consumables cover in Motor Insurance : Protecting Your Vehicle Inside Out

In the realm of motor insurance the term “Consumables Cover” refers to a specialized add-on that provides coverage for the replacement or reimbursement of consumable items that might need frequent replacement due to regular vehicle usage. These items are an integral part of your vehicle’s maintenance and functioning and their wear and tear is inevitable over time. The consumables cover is designed to offer financial assistance for these often overlooked but essential components ensuring that your vehicle remains in optimal condition.

Understanding Consumables : The Essential of Vehicle Maintenance

Consumables encompass a range of items that are routinely consumed or depleted in the course of operating a vehicle. These include:

- Engine Oil : Regular engine oil changes are vital for engine health.

- Coolants : Cooling system maintenance is crucial for preventing overheating.

- Brake Oil : Adequate brake fluid levels ensure optimal braking performance.

- Transmission Fluid : Transmission Fluid keeps the transmission system functioning smoothly.

- Power Steering Fluid : Proper power steering fluid levels maintain steering efficiency.

- AC Gas : Ensuring Optimal refrigerant levels for efficient air conditioning.

- Grease and Lubricants : These keep various components properly lubricated.

- Filters : Air, Oil and Fuel filters require periodic replacement.

Benefits of Consumables Coverage

- Cost saving : Regular replacement of consumables can add up. This cover helps you avoid the financial burden.

- Optimal Vehicle Performance : Timely replacement of consumables ensures your vehicle operates at its best.

- Peace of mind : You are covered for routine maintenance cost, reducing unexpected financial surprises.

3. Return to Invoice (RTI) Coverage (Motor Insurance Add-ons Coverage)

Return to Invoice (RTI) in Motor Insurance : Safeguarding Your Vehicle Investment

Return to Invoice (RTI) is a valuable feature offered in motor insurance policies, providing an extra layer of financial protection for your vehicle. In the unfortunate event of your car being declared a total loss due to theft or an accident, RTI ensures that you receive the original invoice price of the vehicle from the insurance company. This feature is particularly useful in bridging the gap between the depreciated value of your car and the initial amount you paid for it, allowing you to replace your vehicle without a significant financial setback.

Key Features of Return to Invoice :

- Depreciation Coverage : Traditional insurance policies often take into account the depreciation of a vehicle value over time, This means that in the event of a total loss, the payout from the insurance company might not cover the original purchase price. RTI, However bridge this gap by ensuring that you receive the full invoice amount.

- Replacement Convenience : With RTI Coverage, You are better equipped to replace your vehicle with a new one or a similar model without worrying about the shortfall between the insurance payout and the actual cost of a replacement.

- Financial Security : In Cases Theft or accident leading to total loss, the financial burden of having to fund the difference between the market value and the original invoice price can be substantial. RTI provides peace of mind, knowing you are financially protected.

- Purchase Price Guarantee : RTI essentially guarantees that you won’t suffer financial loss due to depreciation. The payout from the insurance company will reflect the initial amount you invested in purchasing the vehicle.

4. Key Protection Coverage (Motor Insurance Add-ons Coverage)

Key Protection in Motor Insurance: Safeguarding Your Access

Key protection within the context of motor insurance is a specialized coverage designed to offer financial security and convenience in case your vehicle keys are lost, stolen, or accidentally damaged.

This often-overlooked aspect of motor insurance steps in to provide assistance during situations that might otherwise be stressful and costly. This article delves into the concept of key protection, its benefits, and its role in ensuring a smoother experience for vehicle owners.

Understanding Key Protection: A Valuable Add-On

Key protection is an optional add-on to your motor insurance policy. It addresses the challenges that arise when you’re faced with key-related mishaps. Modern vehicle keys are no longer just simple pieces of metal they often include advanced technology and intricate mechanisms that make them expensive to replace or repair.

Key protection serves as a safety net, covering the expenses associated with lost, stolen, or damaged keys.

Key Protection Coverage: What It Includes

When you opt for key protection coverage, you typically gain access to the following benefits

- Key Replacement: If your car keys are lost or stolen, the coverage will help you cover the cost of getting a replacement key made which can be a significant expense especially for modern smart keys.

- Locksmith Services: In case you’re locked out of your vehicle due to a key-related issue, key protection can cover the costs of locksmith services to help you regain access to your car.

- Transponder Replacement: Many modern vehicle keys come with transponders or remote unlocking mechanisms, If these components are damaged. Key protection can help with their repair or replacement costs.

- Towing Assistance: If your vehicle is immobilized due to key issues, key protection might offer coverage for towing your vehicle to a repair facility or your home.

5. Tyre Protection Coverage (Motor Insurance Add-ons Coverage)

Tyre protection, often offered as an add-on or rider to your motor insurance policy is a valuable safeguard designed to shield you from the unexpected costs of tyre related damage. Just as your motor insurance covers accidents and collisions.

Tyre protection steps in to address the wear and tear your tyres undergo in the course of regular driving. This unique addition to your policy serves as a buffer against the financial burden that can arise from tyre replacements or repairs.

Key Features of Tyre Protection

- Puncture Repairs: Tyre protection covers the cost of repairing punctures caused by sharp objects on the road. This not only saves you money but also prevents potential safety hazards.

- Tread Wear: Over time, tyres naturally wear down due to regular usage. Tyre protection might offer compensation for replacement when the tread depth reaches a certain limit.

- Road Hazards: From potholes to debris, roads are rife with hazards that can cause tyre damage. Tyre protection can step in to cover repairs or replacements due to such road-related issues.

- Labour Costs: In many cases, tyre repairs involve not only the cost of the tyre itself but also the labor required to install it. Tyre protection can ease the financial burden by covering these associated costs.

- Multiple Claims: Depending on the terms of your policy, you may be able to make multiple claims for tyre-related issues throughout the coverage period.

- Variety of Vehicles: Tyre protection can be tailored to various types of vehicles, from cars to motorcycles, ensuring comprehensive coverage for different modes of transportation.

6. Road Side Assistance Coverage (Motor Insurance Add-ons Coverage)

You are cruising down the highway, enjoying the journey, when suddenly your car splutters to a halt. It’s moments like these when roadside assistance steps in as your dependable guardian, offering a helping hand in times of automotive distress. Let’s delve into the world of roadside assistance in motor insurance, a service designed to provide you with peace of mind on the road.

Key Features of Roadside Assistance

- Towing Services: If your vehicle becomes immobilized and cannot be driven safely, roadside assistance covers the cost of towing your vehicle to a repair facility.

- Flat Tire Assistance: Don’t fret if you’re stuck with a flat tire. Roadside assistance can send a professional to replace it with your spare tire.

- Battery Jump-Start: Stranded due to a dead battery? Roadside assistance dispatches help to jump-start your vehicle, getting you back on the road swiftly.

- Emergency Fuel Delivery: Running out of fuel in the middle of nowhere is no longer a nightmare. Roadside assistance can bring you enough fuel to reach the nearest gas station.

- Locksmith Services: Accidentally locking your keys inside your vehicle is a common mishap. Roadside assistance provides locksmith services to help you regain access.

- Mechanical Assistance: Minor mechanical glitches can be resolved on the spot by a technician dispatched by the roadside assistance team.

- Peace of Mind: Knowing that help is just a phone call away offers tremendous peace of mind for drivers and passengers alike.

- Safety First: Roadside assistance prioritizes your safety, ensuring that you’re not left vulnerable in unfamiliar or potentially unsafe locations.

- Convenience: Dealing with unexpected breakdowns is stressful. Roadside assistance handles the logistics, saving you time and hassle.

- Cost Savings: Without roadside assistance, the cost of towing or emergency services can be steep. This service saves you from unexpected financial burdens.

- 24/7 Availability: Roadside assistance operates round the clock, so whether it’s daytime or midnight, help is available

IF YOUR WANT KNOW MORE ABOUT INSURANCE : CLICK HERE

two wheeler vehicle insurance status check online

how to check vehicle insurance

check vehicle insurance status online parivahan

vehicle insurance status check online

vehicle insurance check

online insurance check