Mastering Personal Finance : Your Comprehensive Guide to Financial Success

In the fast paced modern world managing personal finances is a vital skill that empowers you to achieve stability and independence. This Comprehensive guide breaks down the intricate aspects of personal finance into easily understandable point, enabling you to make informed decisions about your money matters, Let’s embark on a journey through the realm of personal finance and learn ow to seize control over your financial future.

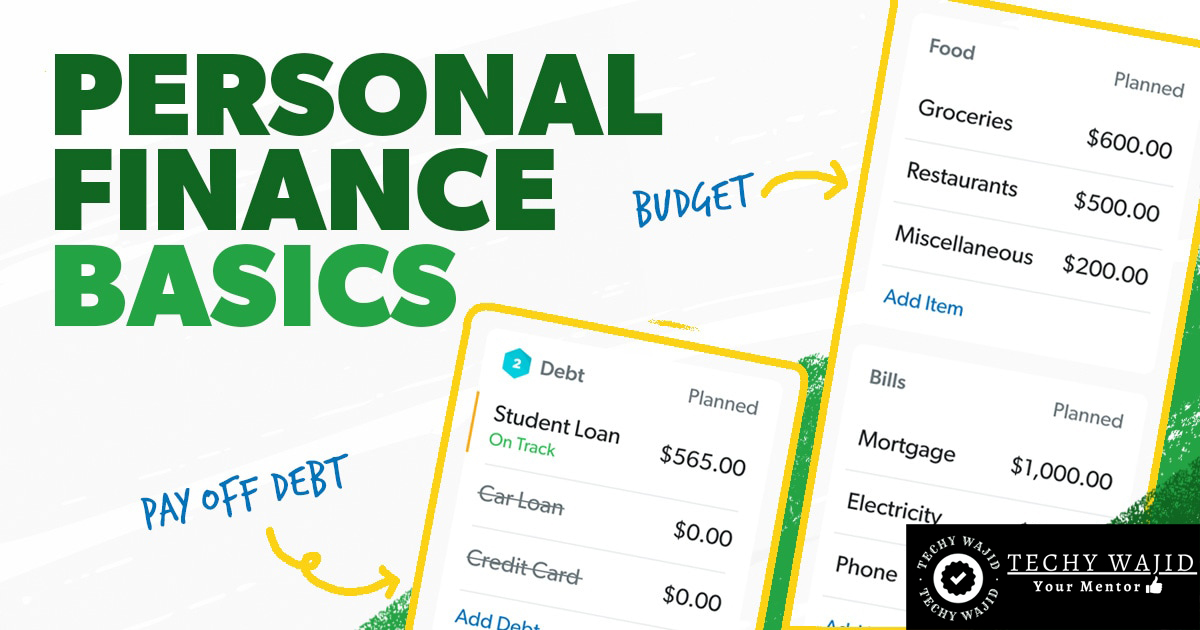

1. Budgeting : The cornerstone of Financial Management (Personal Finance : Your Comprehensive Guide to Financial Success)

Creating a budget is the first step towards understanding your financial health. Break it down like this.

- Income Evaluation : List all sources of income, such as salary, side gigs or investments.

- Expense Breakdown : Categorize expenses into essential (housing, groceries, utilities) and non essential (dining out, entertainment)

- Saving and Investment : Allocate a portion of your income to saving accounts or investment vehicle like stocks and bonds.

2. Building an Emergency Fund : Your Financial Safety Net (Personal Finance : Your Comprehensive Guide to Financial Success)

An Emergency fund acts as a buffer against unforeseen circumstances. Here’s how to set it up.

- Aim for Three to Six months worth of living expenses in your emergency fund.

- It Safeguards you during unexpected events like medical emergencies or sudden job loss.

3. Effective Debt Management : A Strategic Approach (Personal Finance : Your Comprehensive Guide to Financial Success)

Address your debts systematically to regain financial control.

- Debt Priority : Tackle high – Interest debts first like credit card balances.

- Consolidation and Refinancing : Explore option to consolidate multiple debts intoone or refinance for better rates.

- Timely Payments : Maintain a good credit score by paying bills on time.

4. Saving & Investing : Nurturing Financial Growth (Personal Finance : Your Comprehensive Guide to Financial Success)

Grow your wealth by saving and investing prudently.

- Goal Setting : Define specific financial objectives such as buying a home or planning for retirement.

- Early Investing : Benefit from compound interest by starting to invest as early as possible.

- Diversification : Spread investments across various assets like stocks, bonds and mutual funds for reduced risk.

5. Securing Your Retirement : A Future Ready Strategy (Personal Finance : Your Comprehensive Guide to Financial Success)

Plan for Retirement to ensure a secure future.

- Regularly contribute to retirement accounts such as 401-K or an IRA

- Understand your risk tolerance & adjust your investment strategy accordingly.

- Seek Guidance from financial advisor for R.P. (retirement planning).

6. Insurance Coverage : Safeguarding Your Assets & Health

Protect yourself from unexpected financial set backs with comprehensive insurance coverage.

- Obtain health, auto, home and life insurance for comprehensive Protection.

- Review and update coverage with changing life circumstances.

7. Smart Spending : Making Every Dollar Count

Practice Prudent pending habits to stretch your money further.

- Differentiate between needs and wants before making a purchase.

- Hunt for discounts, coupons and cashback deals while shopping.

- Avoid impulsive buying and adhere to your budget.

8. Continuous Learning : Enhancing Your Financial Literacy

Empower Yourself by deepening your understanding of finance.

- Keep educating yourself through books, online resources and workshops.

- Grasp financial concepts like compound interest, inflation and portfolio diversification.

9. Estate Planning : Ensuring Smooth Wealth Transition

Secure a seamless transition of wealth by considering state planning.

- Draft a will to specify how your assets will be distrubuted after your demise.

- Explore trust for more intricate estate planing needs.

10. Regular Financial Check – ins : Monitoring & Adapting. (Personal Finance : Your Comprehensive Guide to Financial Success)

Foster financial progress through consistent evaluation.

- Regularly review your budget, saving & investment portfolio.

- Adjust your financial plan as your goals evolve & life circumstances change.

Remember, Personal finance is an ongoing journey, By following these steps, tailored to your unique circumstances, you have establishing a foundation for financial success. Adapt these principles to your life and maintain a proactive approach. Your commitment to mastering personal Finance will lead you towards a future of financial well – being & empowerment.

3 thoughts on “Personal Finance : Your Comprehensive Guide to Financial Success”