Vehicle Insurance Common Add-Ons Coverage Details (Motor Insurance Add-ons Coverage)

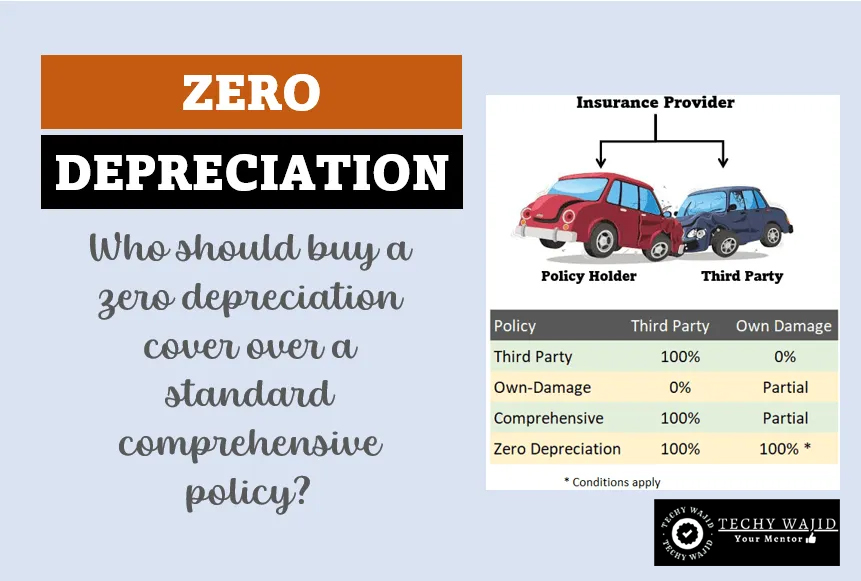

1. Zero Depreciation

Zero Depreciation, Also known as Nil Depreciation or Bumper to bumper insurance is a unique feature offered in motor insurance policies, Unlike standard insurance, which factors in depreciation while settling claims, Zero Depreciation coverage ensures that you receive compensation for the full cost of repairing or replacing damage car parts without accounting for depreciation. This can be especially advantageous for newer vehicle and those equipped with advanced technologies.

Benefits of Zero Depreciation Coverage (Motor Insurance Add-ons Coverage)

- Zero depreciation coverage is highly beneficial for new cars, as their value depreciates significantly in the initial years. This coverage ensures that you do not have to bear the brunt of this depreciation when making a claim.

- High End cars often come with expensive parts and advanced technology. Zero Depreciation coverage ensures that you are adequately compensated for the cost of these parts, which may be subject to higher depreciation.

- New or inexperienced drivers may have a higher likelihood of minor accidents. Zero Depreciation coverage helps alleviate the financial burden of repairing such damages.

- Cost Savings : You save in out of pocket expenses as the insurer covers a larger portion of repair costs.

- Peace of mind : You can drive with confidence knowing that even in case of damage you won’t have to bear the burden of depreciation related deductions.

- Timely Repairs : This coverage encourages Prompts repairs, maintaining your vehicle’s aesthetics and safety features.

Limitation & Considerations

- Age of the Vehicle : Zero Depreciation coverage might have limitation based on the age of the vehicle. Some insurers offer this coverage only for cars up to a certain age, often around 2-3 years.

- Higher Premiums : Opting for Zero Depreciation Coverage typically result in a higher insurance premium compared to standard coverage. However the benefits often outweigh the increased cost, especially for newer or high value vehicles.