Types of Motor Insurance : Tailoring Protection for Your Wheels (Types of Motor Insurance | All Complete Details)

When it comes to safeguarding your vehicle and our peace of mind, motor insurance comes in various flavors each designed to meet specific needs and circumstances. From comprehensive coverage to specialized policies, understanding the types of motor insurance available empowers you to make informed decision. Lets take a closer look at the different types of motor insurance and what they offer. (Types of Motor Insurance | All Complete Details)

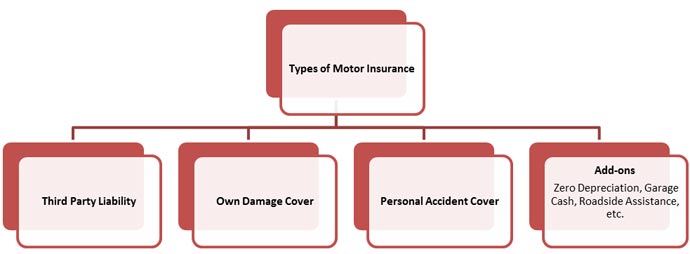

1. Third Party Liability Insurance : The Foundation of Protection

(Types of Motor Insurance | All Complete Details)

Consider third party liability insurance as the bedrock of motor insurance. It is often mandated by law and provides coverage for damages and injuries caused to third parties by your vehicle. This means that if your are at fault in an accident the injured parties medical expenses, property damage and legal fees are covered by your insurance, While third party liability insurance is the most basic level of coverage its essentional for legal compliance and protecting your financial interests.

2. Comprehensive Insurance : A Holistic Safety Net

Comprehensive insurance take protection to the next level, It covers not only third party liabilities but also damages to your own vehicle. Think of it as all encompassing safety net against a wide range of risks, including collisions, theft, vandalism, natural disasters and more with comprehensive insurance your can drive with the confidence that both your vehicle and your financial interests are shielded from various uncertainties.

3. Collision Insurance : Focus on Accidents (Types of Motor Insurance | All Complete Details)

If you are primarily concerned about covering repair cost for your own vehicle after a collision, collision insurance might be your choice. Unlike comprehensive insurance, collision coverage specifically caters to damages resulting from accidents. Whether its a minor fender bender or a more serious collision, collision insurance ensures that you are not left with the bill for repairing or replacing your vehicle.

4. Personal Injury Protection (PIP) or Medical Payments coverage : Health Comes First (Types of Motor Insurance | All Complete Details)

in accident injuries can extend beyond vehicles to the people inside them, PIP or medical payments coverage steps in to cover medical expenses for you and your passengers, regardless of who’s at fault. PIP is broader and might also cover lost wages and other expenses related to the accident. This type of coverage places the focus on your well being and well being of those riding with you.

5. Uninsured / Under-insured Motorist Coverage : Protecting Against the Uninsured (Types of Motor Insurance | All Complete Details)

Imagine being involved in an accident with a driver who does not have insurance or has inadequate coverage. Uninsured / Under-insured motorist coverage ensures that you are still protected. If the at fault driver can not cover your medical expenses or vehicle repairs, your own insurance steps in. it is a safety net against scenarios where the other party can not fulfill their financial obligations.

6. Gap Insurance : Bridging the Depreciation Gap (Types of Motor Insurance | All Complete Details)

When you purchase a new vehicle its value starts depreciating the moment it hits the road. in the unfortunate event of a total say, due to theft or a severe accident your insurance payout might not cover the outstanding loan or lease balance. Gap Insurance bridges this gap, Ensuring that you are not left with the burden of paying for a vehicle you no longer have.

7. Vintage / Classic Car Insurance : Nurturing Nostalgia

For those who own vintage or classic cars, standard motor insurance might not suffice. These vehicles often hold sentimental and historical value, requiring specialized coverage that considers their unique attributes. Vintage or classic car insurance takes into account factors like limited use restoration costs, appreciation in value over time.

Choosing the Right Type of Motor Insurance (Types of Motor Insurance | All Complete Details)

Selecting the appropriate type of motor insurance depends on your circumstances, preferences and priorities. Consider the following steps when choosing your coverage.

- Assess Your Needs: Evaluate hour driving habits the value of your vehicle and your budget

- Research Option: Understand the types of coverage available and how they align with your needs.

- Consider Additional Coverage: Depending on your situation think about add-ons like road side assistance or rental car coverage. (Types of Motor Insurance | All Complete Details )

- Compare Quotes: gather quotes from different insurance providers to find the best value for your coverage.

- Consult Professionals: Insurance agents or brokers can offer expert guidance tailored to your specific needs.

Conclusion: Tailored Protection for Your Journey (Types of Motor Insurance | All Complete Details )

Just as vehicles come in various makes and models, motor insurance offers a diverse array of coverage options. From ensuring legal compliance to safeguarding your vehicle and well being the type of motor insurance cater to a spectrum of needs. As you navigate the road of life remember that the right type of motor insurance is not just a legal requirement , its your personalized shield better equipped to make choices that align with your driving habits, lifestyle and peace of mind.